Custom Private Equity Asset Managers Fundamentals Explained

Wiki Article

Custom Private Equity Asset Managers Things To Know Before You Get This

(PE): investing in companies that are not openly traded. Approximately $11 (http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map). There might be a few things you do not understand regarding the market.

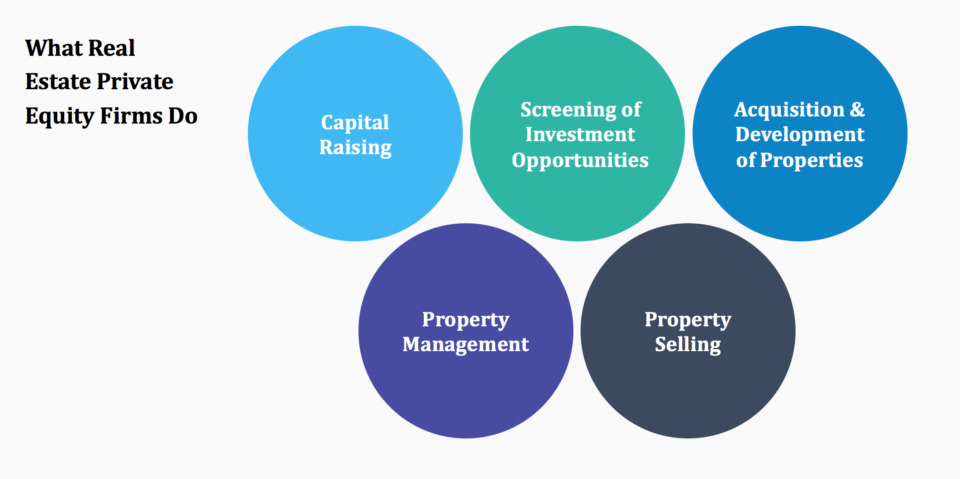

Companions at PE companies elevate funds and take care of the cash to generate desirable returns for investors, commonly with an investment perspective of between 4 and 7 years. Private equity firms have a variety of financial investment choices. Some are rigorous sponsors or passive capitalists entirely based on monitoring to grow the business and generate returns.

Because the most effective gravitate toward the bigger bargains, the center market is a dramatically underserved market. There are extra vendors than there are very skilled and well-positioned financing professionals with substantial purchaser networks and resources to take care of an offer. The returns of personal equity are commonly seen after a couple of years.

The Definitive Guide for Custom Private Equity Asset Managers

Traveling below the radar of huge multinational corporations, a lot of these small business usually give higher-quality consumer solution and/or particular niche items and services that are not being supplied by the big empires (https://www.viki.com/users/cpequityamtx/about). Such advantages attract the passion of exclusive equity companies, as they possess the insights and smart to exploit such chances and take the firm to the next degree

Many managers at portfolio business are given equity and benefit payment structures that compensate them for hitting their financial targets. Private equity chances are usually out of reach for individuals who can't spend millions of bucks, but they shouldn't be.

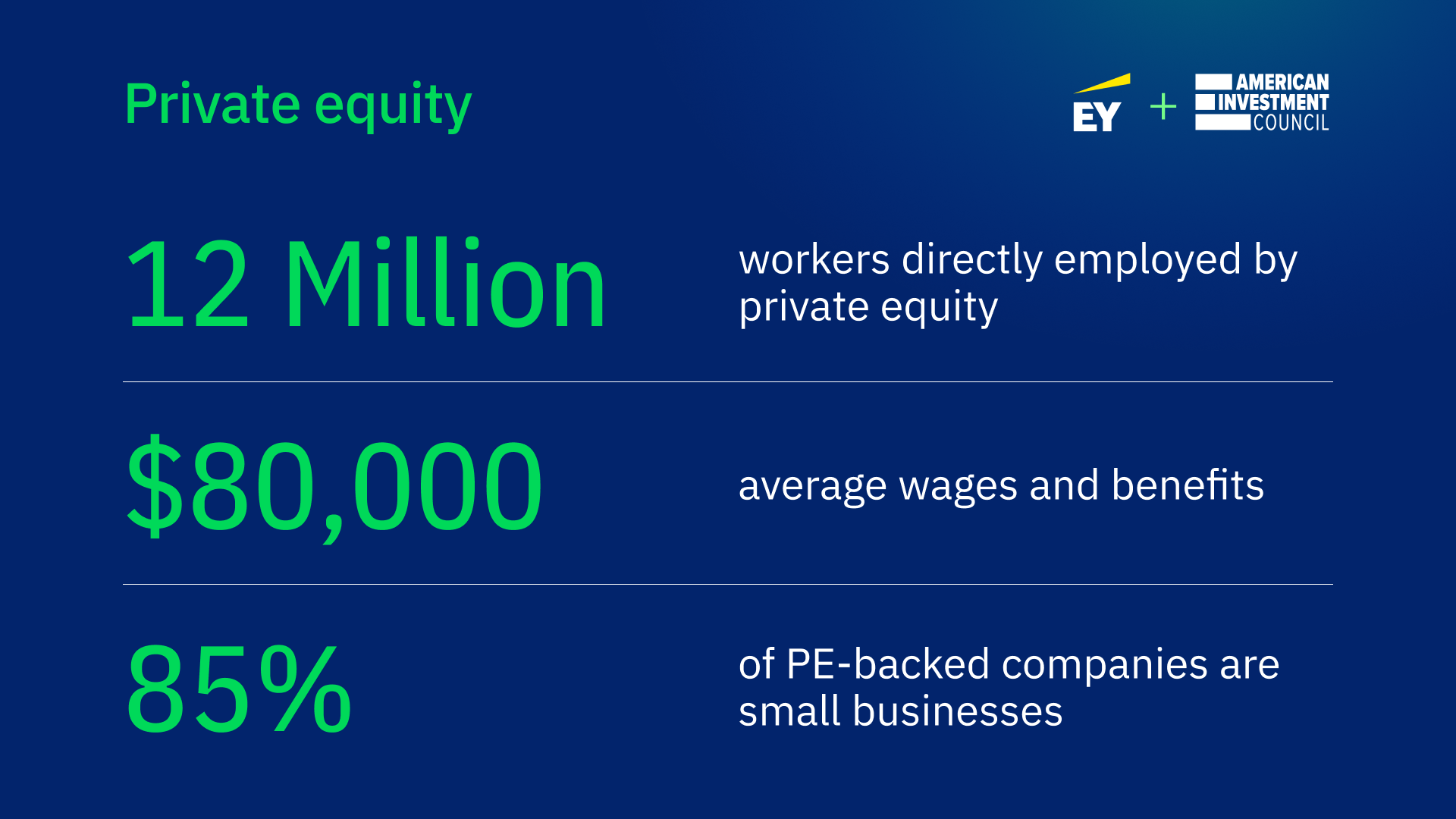

There are regulations, Visit Website such as limitations on the accumulation quantity of cash and on the variety of non-accredited capitalists. The exclusive equity organization brings in some of the ideal and brightest in business America, consisting of top performers from Ton of money 500 companies and elite monitoring consulting firms. Law office can additionally be recruiting premises for personal equity hires, as accounting and legal skills are necessary to complete bargains, and purchases are very demanded. https://anotepad.com/note/read/gtek6cnk.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

One more downside is the lack of liquidity; once in a private equity transaction, it is not simple to get out of or offer. There is an absence of versatility. Private equity additionally features high fees. With funds under management already in the trillions, exclusive equity firms have actually come to be eye-catching investment vehicles for wealthy individuals and organizations.

Currently that access to personal equity is opening up to more specific investors, the untapped capacity is ending up being a reality. We'll begin with the major debates for spending in personal equity: Just how and why private equity returns have historically been greater than various other assets on a number of levels, Just how including private equity in a profile affects the risk-return profile, by assisting to branch out versus market and cyclical risk, After that, we will lay out some crucial factors to consider and threats for private equity capitalists.

When it pertains to introducing a brand-new asset into a profile, the many basic consideration is the risk-return profile of that possession. Historically, private equity has exhibited returns comparable to that of Emerging Market Equities and higher than all other conventional asset classes. Its relatively low volatility combined with its high returns creates a compelling risk-return profile.

All about Custom Private Equity Asset Managers

Actually, exclusive equity fund quartiles have the best array of returns throughout all alternate property courses - as you can see below. Methodology: Inner rate of return (IRR) spreads determined for funds within classic years separately and afterwards averaged out. Typical IRR was computed bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund option is essential. At Moonfare, we accomplish a rigorous option and due persistance process for all funds noted on the platform. The effect of including private equity into a profile is - as constantly - depending on the profile itself. A Pantheon study from 2015 suggested that including exclusive equity in a profile of pure public equity can open 3.

On the other hand, the best private equity companies have access to an also larger pool of unknown possibilities that do not face the exact same examination, in addition to the resources to execute due persistance on them and recognize which deserve buying (Private Equity Platform Investment). Spending at the first stage indicates greater threat, however, for the firms that do succeed, the fund gain from higher returns

8 Easy Facts About Custom Private Equity Asset Managers Explained

Both public and exclusive equity fund supervisors devote to spending a percent of the fund but there remains a well-trodden problem with lining up rate of interests for public equity fund administration: the 'principal-agent problem'. When an investor (the 'primary') works with a public fund supervisor to take control of their resources (as an 'agent') they entrust control to the supervisor while preserving ownership of the properties.

In the case of personal equity, the General Partner doesn't simply gain an administration fee. They also gain a portion of the fund's earnings in the type of "carry" (typically 20%). This makes sure that the interests of the supervisor are straightened with those of the capitalists. Private equity funds also reduce another kind of principal-agent trouble.

A public equity investor ultimately desires one point - for the monitoring to boost the supply price and/or pay out dividends. The capitalist has little to no control over the decision. We revealed over just how numerous exclusive equity methods - specifically majority acquistions - take control of the running of the company, ensuring that the long-term worth of the firm precedes, pushing up the return on investment over the life of the fund.

Report this wiki page